Market Update: Current Market Environment and Addressing Volatility

May 25, 2022 | by John D. Wolfsberg, CFA, CFP®

In light of the recent volatility in equity and fixed income markets, we wanted to reach out to provide some insight into the bond market and provide some charting to show historical volatility in the equity market in context.

Fixed Income Markets:

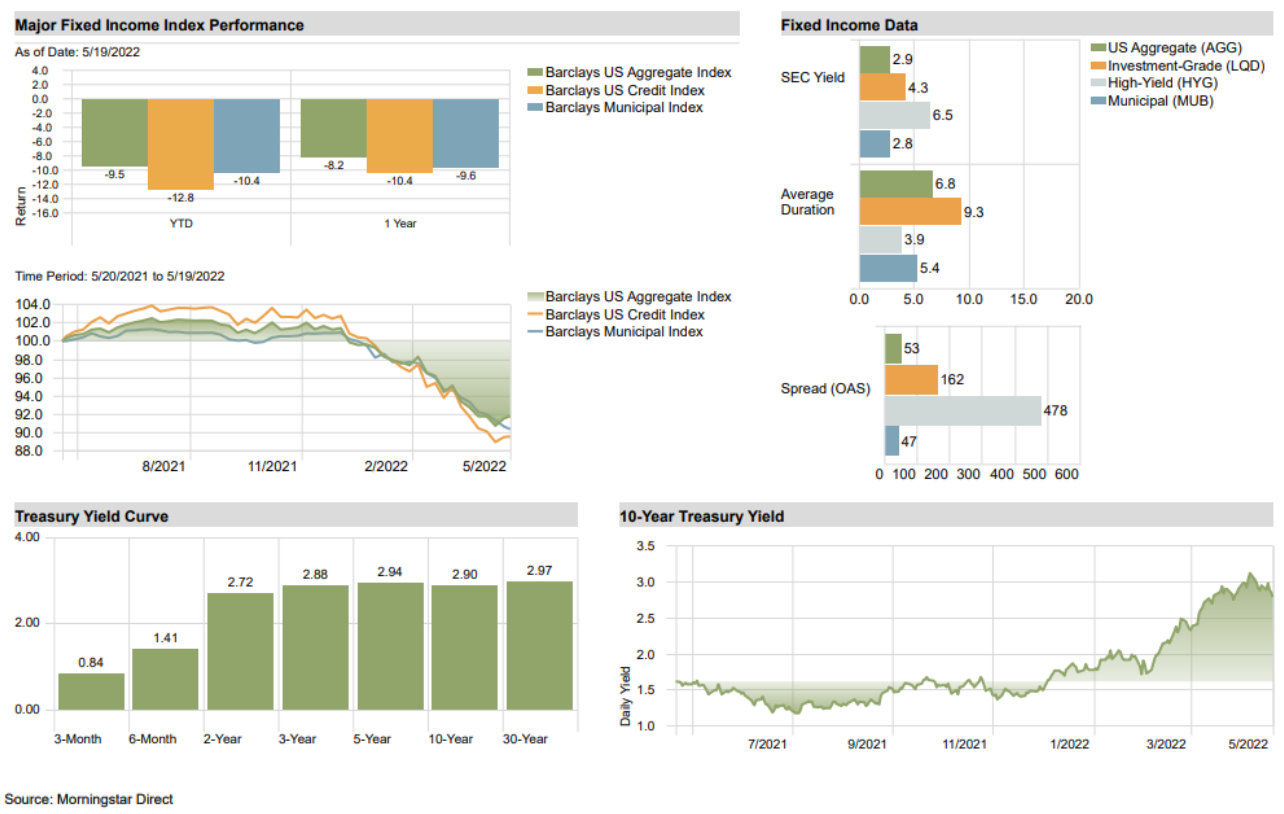

To provide some background to the recent bond market performance, the bond market is experiencing the most severe price decline in forty years with the Barclays Aggregate Bond Index down -9.5% as of last night’s close. At the height of the pandemic, the Federal Reserve cut the Federal Funds Rate (one of their primary tools to stimulate the economy) to zero and also grew their balance sheet through the purchase of treasuries. Both interest rates at the short-end and long-end of the yield curve were at record lows during the height of the pandemic, resulting both from unprecedented stimulus as well the ‘flight-to-quality’ trade as market participants initially exited equities and funds flowed into treasury bonds.

The stimulus provided both by monetary and fiscal policy boosted consumers balance sheets, driving strong consumer demand that supply chains struggled to keep up with. This was one of the initial root causes to the inflation that we are seeing today. The Federal Reserve initially called inflation ‘transitory’ which became the buzz word of 2021. Unfortunately, it was realized by the Fed and by market participants that they were in fact behind in reeling in inflation and that they would need to engage in an aggressive rate-hiking cycle to address the inflation numbers. As a result, interest rates have risen from record lows as the market has been pricing in higher-than-expected inflation as well as interest rate hikes by the Fed.

While painful in price performance in the short-run (bond prices fall as interest rates rise), this will actually be healthy in the long-run. As interest rates reset higher, bond investors will be able to reinvest proceeds from maturing bonds at higher interest rates. This will cause portfolio yields to rise over time, allowing for a greater contribution over the long-run from the fixed income allocation to a portfolio’s total return. If interest rates remained near zero or 1% over the long run, the fixed income allocation would only be expected to act as a diversifier to equities without contributing much to returns.

Equity Markets:

Equity markets are experiencing heighted volatility over the same concerns that the bond markets have; rising interest rates. Low interest rates allowed equity valuations to run higher than their historical averages as lower interest rates allow for a lower discount factor to future earnings, which translates into a higher expected value. As rates have risen, future earnings are being discounted at higher rates causing valuations to fall. This especially affects companies whose valuations are based off the expectation of higher earnings in the future versus the near term i.e. growth stocks.

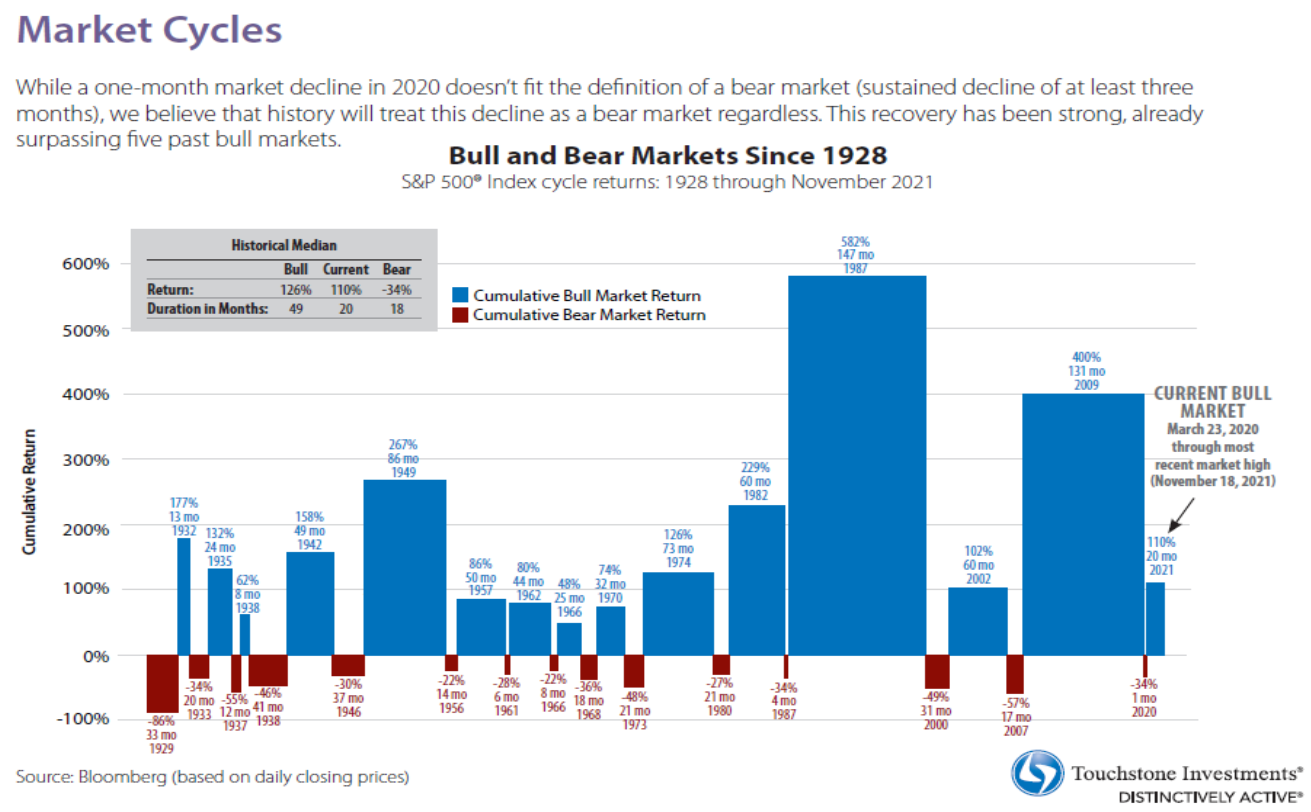

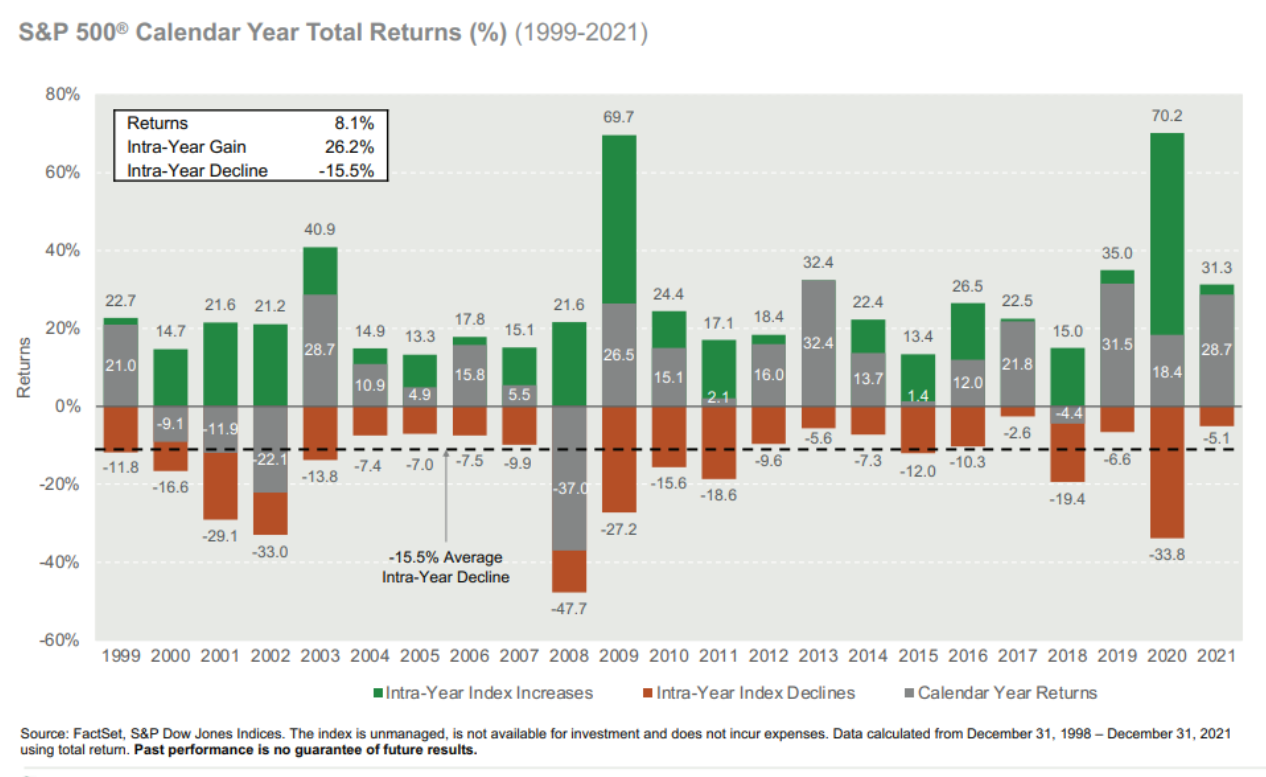

To provide some historical context to the current market volatility, I have attached a few charts.

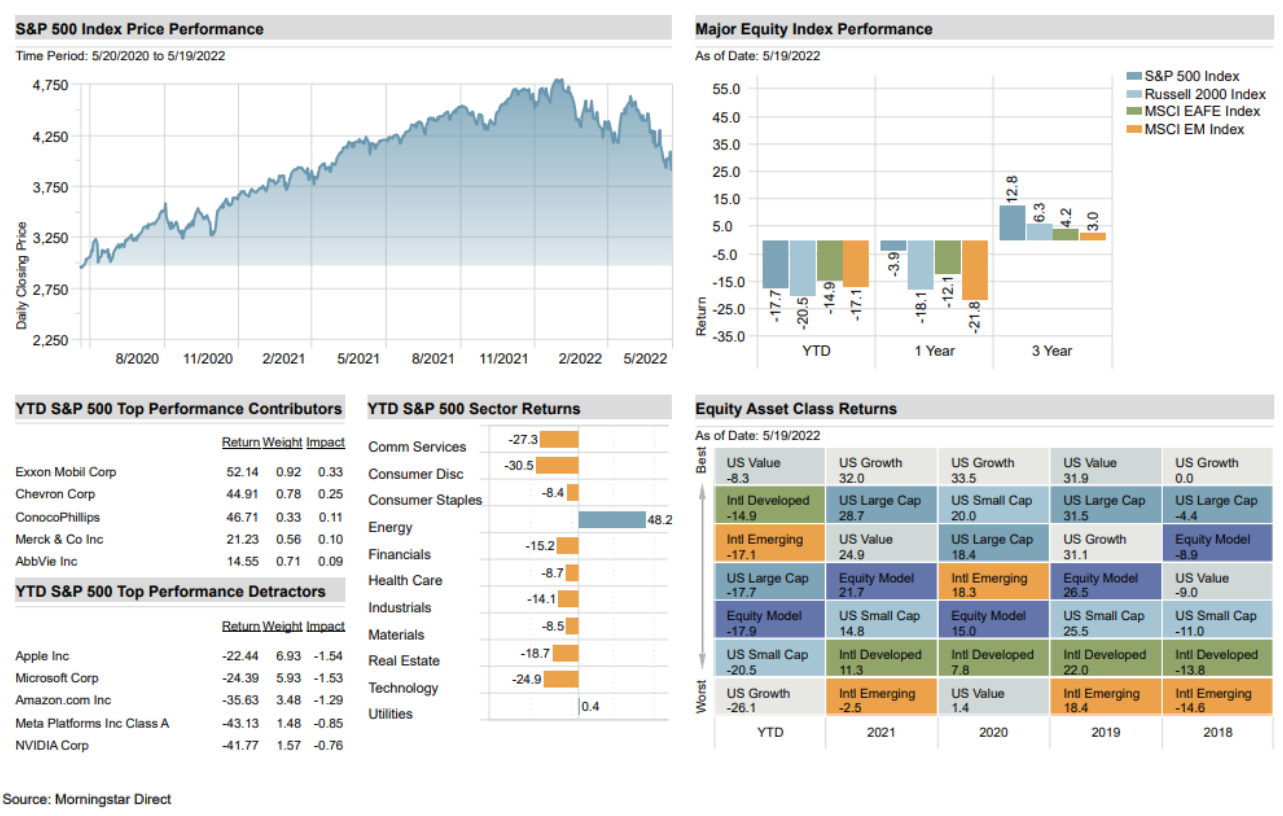

The following chart provides a snapshot of where equity markets are year-to-date as of the close on 5/19/2022. What you’ll note is that the primary detractors from the S&P 500 are investors’ favorite growth stocks from the prior 5 years. The only sector that has really outperformed on a meaningful basis is Energy. The sector has recovered after being the worst performing sector in 2020 with already tight supply (boosting oil prices) exacerbated by the war in Ukraine.

Source: Morningstar Direct

Similarly to the previous chart, the following provides a snapshot of where fixed income markets are year-to-date as of 5/19/2022. The primary takeaway is that rising yields have negatively impacted nearly every segment of the bond market year-to-date.

Source: Morningstar Direct