Guest Blog: Is Long-term Renting a Bad Choice?

September 15, 2021. By Ashley Agnew:

A frequent question we receive from young professionals and those looking to downsize alike is simply this: is it worth it to buy a home? While there is no concrete answer and many factors to consider, we love this response from Natasha Knox, CFP, FBS, the principal of Alaphia Financial Wellness. I have the pleasure of being a fellow member of the Financial Therapy Association with Natasha, so when I came across this feature in the Money Sense online magazine, I was excited to share with our readers. Thank you to both Money Sense and Natasha for bringing this conversation to life from not only a financial but also emotional angle*:

A MoneySense reader writes:

“With the price of real estate continuing to rise all around me, I’ve been wondering about the viability of being a long-term renter. I understand that there are strong financial benefits to owning a home—my family keeps bringing them up!—but I’m not sure that will ever be in the cards for me. I don’t have a down payment saved, and it seems like the amount I would need to save just keeps going up and up. I’m also not sure that home ownership is the right choice for me in any case: I’m single and I’m not 100% sure I’m going to want to live in the same place for a long time. Is being a renter really such a bad financial choice? “

You’re not alone in questioning the viability of long-term renting.

The decision to buy or rent a home is a big one—and the first step in making any big financial decision, including home ownership, is evaluating your own situation on its own merits—that is, based on the facts, rather than options and emotions.

With home ownership, the facts you need to take into consideration include your income, your ability to save up a down payment, and your plans for where you’ll live.

Real estate is similar to many other assets: Over the short term, it can fluctuate in value considerably, but over the long term, it tends to increase in value. If you purchase with a short-term time horizon, you will significantly increase your chances of sustaining a loss due to closing costs you have to cover with each transaction (such as land transfer taxes on a purchase, and legal fees on a purchase or sale) and market swings. On the other hand, if you have plans to hold it long-term, you’re more likely to realize the benefits of appreciation in the asset. Based on your current uncertainty about staying in one place, I would suggest renting over home ownership, regardless of the affordability of the housing market.

The second part of your question is about the wisdom of being a long-term renter. This question is becoming much more salient as housing prices rise across the country. Renting can be a highly prudent choice and—from a financial perspective—depending on your circumstances, renting can make more sense than buying, even over the long term. Here’s why:

Real estate “carrying costs” involve more than just the monthly mortgage payment

Many people decide to buy homes based simply on the amount of the monthly mortgage payment, assuming that if the mortgage payment “costs the same as rent,” then buying makes sense.

This way of thinking often grossly underestimates the true cost of home ownership, however; for one, it doesn’t factor in the opportunity cost of growth on the initial down payment and upfront costs if those costs were invested. Equity-based market investments have historically outperformed real estate.

There are also lots of unrecoverable transaction costs when you’re buying or selling a home, such as real estate commissions, closing costs and land transfer taxes.

And then there are the ongoing costs of home ownership, such as maintenance and repairs, and the higher insurance costs you’ll face as a homeowner. These expenses together might add 1% to 2% percent of the home’s value to your annual costs.

Additionally, if you’re in an area with high housing costs, like Greater Vancouver or the Greater Toronto Area, you may be able to rent a space in a highly walkable, transit-friendly neighborhood in the city itself, whereas purchasing may mean moving into an adjacent community, thus significantly increasing your transportation costs.

If you rent, you could come out ahead financially over the long term

Compared to an owner, a prudent renter could potentially save some of the money they might otherwise put towards home ownership. Depending on your tax bracket, if you’re saving in an RRSP, those savings may be amplified by the benefit of tax deferral on your saved contributions.

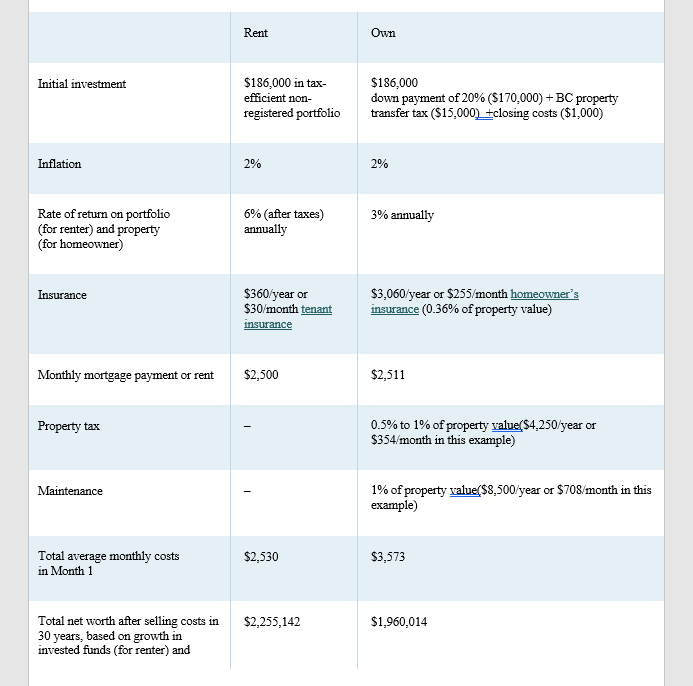

Here’s an example of how this could play out in real life, based on a home in BC, with a few big assumptions. First, I’ve assumed the renter is investing the difference in cash flow between renting and owning in a well-diversified, primarily equity-based, non-registered portfolio. Secondly, I’ve assumed the interest rate on the mortgage will stay level throughout the course of the mortgage. If interest rates go up over the course of a long mortgage (and they most likely will), that will increase the costs of home ownership and could tip the scale even further toward renting. With those assumptions in place, I’ve modelled how a homeowner and a renter might fare after 30 years.

Comparing the costs of renting versus owning: example in British Columbia $850,000 purchase price:

For a detailed exploration of the numbers, I recommend reading this White Paper from Ben Felix of PWL Capital, as well as using this calculator (also created by Felix) that will allow you to input your own numbers and assumptions. Creating your own calculations lets you see the outcomes if you use different assumptions about investment portfolio growth or housing equity growth, for example.

Making long-term renting the best financial choice will hinge on your savings discipline to invest the difference between theoretical ownership costs and the actual lower renting costs. To harness the advantages of your lower costs, first determine how much you need to be saving to meet your goals and, next, ensure that you set up automatic savings to get there.

Exploring your beliefs about renting and buying

For many people, however, the math of the “rent versus buy” decision is only part of the equation. Home ownership is a decision that people make based on what home ownership means to them. If you find that renting makes the most financial sense for you, but you’re still uneasy about renting long-term, you might wish to explore some of your beliefs around home ownership and renting.

Here’s an exercise that you can try with old-fashioned pen and paper. Finish these statements with the first answer that pops into your head, trying not to censor yourself or think about your responses for too long.

-

- People accumulate wealth by…

- The smartest thing I can do with my money is…

- The most foolish thing I can do with my money is…

- Home ownership is…

- Long-term renting is…

- If I tell people that I have chosen to rent they will think…

- If I tell people that I have chosen to buy a place they will think…

- Indebtedness is…

- Financial security is…

- Financial freedom is…

Once you’ve completed this exercise, take a moment to consider what you’ve written. For each of your answers, ask yourself:

-

- Is this belief true? How do I know it’s true? Could the opposite also be true?

- How do I feel when I believe this thought?

- If I no longer believed this, what would be different? What would I do differently? How might I feel if I no longer believed this?

- Is this a helpful way to see this issue, or is it limiting me in some way?

- Is there another way to think about this issue that might be more helpful?

Completing this exercise can help you uncover the emotions that might be underneath your thinking about renting versus buying, even if you’re not consciously aware of them.

Communicating with family about your choices

Hopefully this column has given you some ideas about how to approach making this decision for yourself, by digging into both the numbers and your emotional motivations. The goal in completing these exercises is to help bring you closer to understanding what the right solution is for you, based on your unique circumstances.

Then, once you’re confident and at peace with your decision, addressing well-intentioned comments from your family will be so much easier. Chances are, their remarks are spurred by a basic desire to know that you are financially secure and doing well.

As a society, we are undergoing a collective unlearning of what was once widely accepted as good common sense for all—namely, home ownership. Your family is likely commenting from a belief that what worked for them is what will also work best for you.

If you are routinely investing and you know you’re doing enough to secure your financial future, you may wish to acknowledge the love in their sentiments, and then let them know about the plan you’ve put in place that makes sense in today’s real estate climate and for your situation, and that it will secure your financial future.

~~~

*The original article can be found at https://www.moneysense.ca/columns/qualified-advice/renting-vs-home-ownership-can-you-be-financially-secure-without-buying/ and was originally crafted for Canadian audiences; kindly note monetary examples may reflect as such. While amounts and results may differ from the example referenced, we hope you found this article especially helpful in exploring some key emotional elements of residential decisions. We find that the exercise provided within the article helps with many financial decisions and is a great reflection, journal practice, and conversation starter among partners. If we can be of any assistance in navigating these decisions or discussions, please reach out. We are here.